FinTech Has Forced the Financial Services Industry’s Hand on Digital Experience

The times they are a changing. Digital Disruption is a reality that companies across every industry have to live with. The financial services industry is no different. Ten years ago FinTech was a nice idea, something that may get big in the future. The large lending corporations were comfortable and confident that they could continue business as usual while Silicon Valley attempted to get a foot in the door of the lending business. Surely people wouldn’t feel comfortable depositing and borrowing with some unknown group of 20 and 30 somethings operating out of a garage.

But then, the unthinkable happened. FinTech grew at rates that would have been unthinkable, especially given the economic uncertainty caused by the Great Recession. By 2018, FinTech companies were originating 38% of all personal loans in the US. Now, FinTechs are coming for a piece of the $15 trillion mortgage business, with companies claiming they can reduce the entire application and approval period to 30 minutes and significantly cut down human labor costs in processing, estimated to stand at around 70%.

In response, financial institutions have greatly increased spending on digital technologies and improving the consumer experience. Spending on digital advertising among financial services institutions is projected to surpass $13 billion this year and retail banking operations are set to spend a further $13 billion on digital banking technologies. Larger institutions have adapted an “If you can’t beat them, acquire them” attitude which has led to some of the biggest deals in the industry over the past few years. But where does this leave smaller institutions who don’t have the resources. Are they to be left on the sidelines in the digital playground? How can they show their customers that they are living in the year 2019 unnecessary spending?

Don’t try to beat them at their own game. Of course investing in digital technologies and becoming more mobile friendly is important. Any institution that thinks it can get by without at a bare minimum staying up to date with mobile technologies in the era of smart phone dominance is fooling itself. However, trying to out-innovate FinTech is a race that cannot be won. Just ask Sears how trying to compete against Amazon and Walmart on cost cutting worked out for them.

Instead, credit unions need to upgrade their digital experience strategically in a way that builds on their core value proposition to members. For credit unions, the goal should not be to develop the next Earth-shattering technology, but to utilize digital channels to improve the consumer experience and reinforce the image of credit unions as being trustworthy lenders, operating in the best interests of the community. Engaging with members and potential members on social media and making the banking experience convenient and mobile friendly does not require buying a multimillion-dollar blockchain startup. It does require the commitment to customer service that made credit unions the primary banking choice for 115 million Americans in the first place.

Small banks and credit unions need to approach advances in digital technologies and communications not as a threat to their very existence, but as an opportunity to connect with consumers in a more effective, cost efficient manner. Social media is a cost-effective way to reach the over 75% of American adults who are active on an array of platforms. While many consumers may not yet be ready to conduct the entire mortgage process online with no human interaction, 43% of borrowers at least want to be able to start the process online. Adding mobile features that allows to customers to easily access information and begin applications online is relatively easy way to stay up to date.

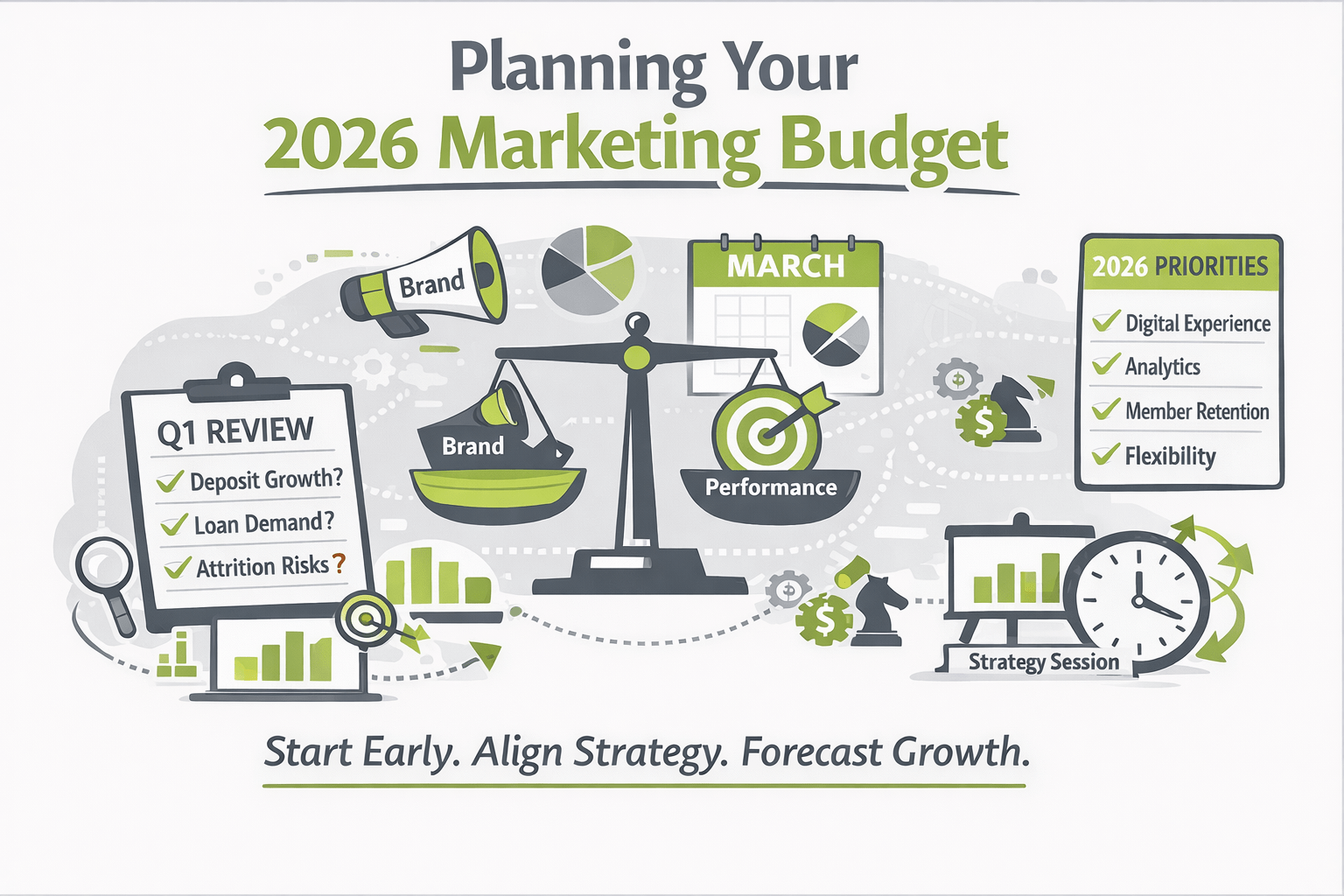

Enhancing the digital experience and connecting with consumers via digital channels is one of the most important things financial institutions can invest in over the coming years. Doing so begins with developing a digital strategy that makes the most of your marketing dollars to reach the right people. Strategis has 20 years of experience helping clients stay ahead of the curve with digital marketing initiatives that deliver results. Contact us today to learn how we can help you!