Don’t Get Left In The Dust of New Mobile & Online Banking Services

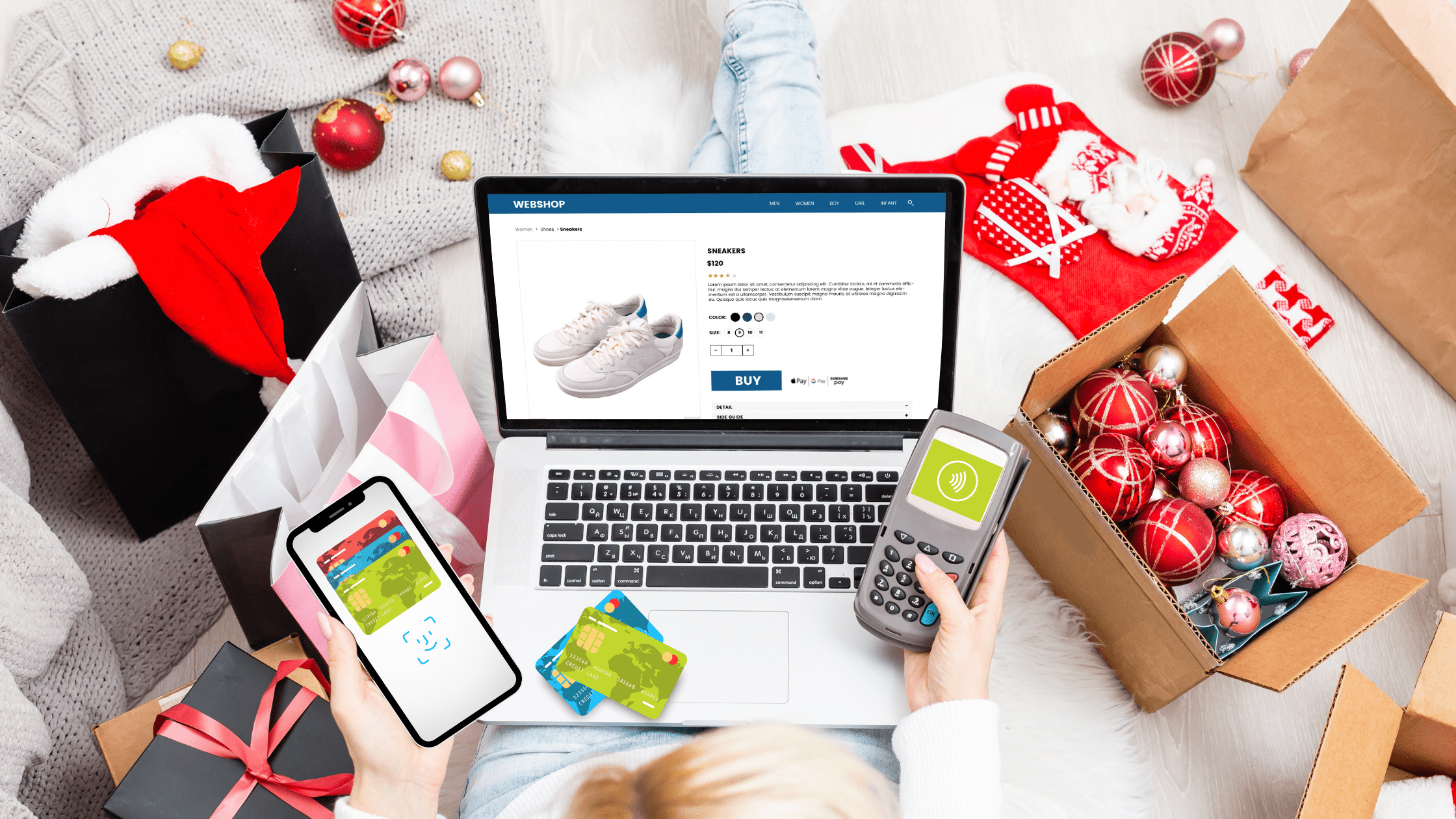

Partnering with a basic online financial company is the best way to lose every potential Millennial customer that you market to. The digital world moves at lightning speed and financial institutions must keep up. If your financial partners or merchant services are not keeping up with emerging and cutting edge trends, then with one customer click you could lose a sale. People interact with their money and pay for services in different ways, and they require convenience in their banking! Here are just a few of the cutting edge features that technology-savvy customers would enjoy.

Mobile App Fingerprint ID

With increased financial mobility within the mobile space comes a need for higher security. Savvy customers prefer to do business with companies that they know will protect their information. Working to integrate a mobile fingerprint ID as part of your financial app showcases your knowledge of cutting edge security and your ability to bring customers technology with their banking.

Flexible Money Transfer Services

The average Millennial customer is into many different types of money transfer options. They may not want to pay you from a certain account, and believe it or not, this is enough to stop them from becoming a customer. Incorporate flexible money transfer options so that your customers can pay you in the way that they prefer.

Integrating Credit Card Services

Many banking customers not only have a debit card, but also have a credit card issued through their bank. Online banking services and mobile apps should have credit card services accessible in the same manner as account services. Viewing credit card balance, credit limit, making payments, and other credit card services should be easily accessible from anywhere for users.

Simplify Mobile Deposit

Moving finances should be easy – this goes without saying. You should not cause your customers to think that your company is the bottleneck between them and the proper use of their own money. Be sure your mobile app and online banking services have a simple, easy and seamless mobile deposit process in place. This goes not just for personal accounts, but for business accounts as well.

Live Online Chat

Creating a personal relationship with your online banking customer base is a great way to build a loyal audience. Not only do you gain access to your customers directly, but they also will be more willing to work with you during technical issues. Live online chats allow you to directly help your customers without them having to pick up the phone or physically visit your branch.

Incorporating these new and cutting edge services into your online banking on your website and into your bank’s mobile app will help you better attract and serve your customers – especially the technologically savvy ones. If you’re interested in auditing your online banking and financial website, sign up for a free website audit now!