Unwrapping 2023’s Payment Trends for the Holidays

The holidays are here, and spending continues its upward trajectory this season. The average consumer is expected to spend $1,530 between gifts, travel, and entertainment during the 2023 holiday season. With holiday sales starting early, many have already begun or finished shopping, making this a great time to look at this year’s payment trends. Join us as we dive deeper into the new digitized world of making payments and what it means as we shift into the new year.

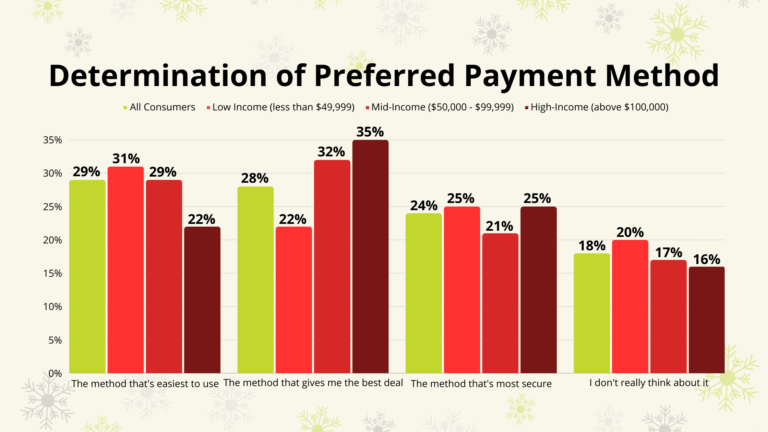

Payment Method Decision-Making Factors

The highest priorities when choosing a payment method this time of year are ease of use and getting the best deal. Breaking this down by income, those with a lower annual household income are more likely to prioritize which payment method is “easiest to use” and are also the most likely “not to think about it.” On the other hand, those with a mid-level annual household income and those with a high annual household income are more likely to use the payment method that offers “the best deal,” with mid-income earners also very likely to consider the ease of use.

What does this mean for banks and credit unions?

It’s essential to craft payment experiences that are as easy as possible, both online and in-person, by offering the latest seamless payment technologies. Additionally, offering holiday incentives like special rates, bonuses, and more will help draw in those searching for the best deal. The secret ingredient to success is incorporating these offerings into clear messaging that reaches current and prospective customers all season long.

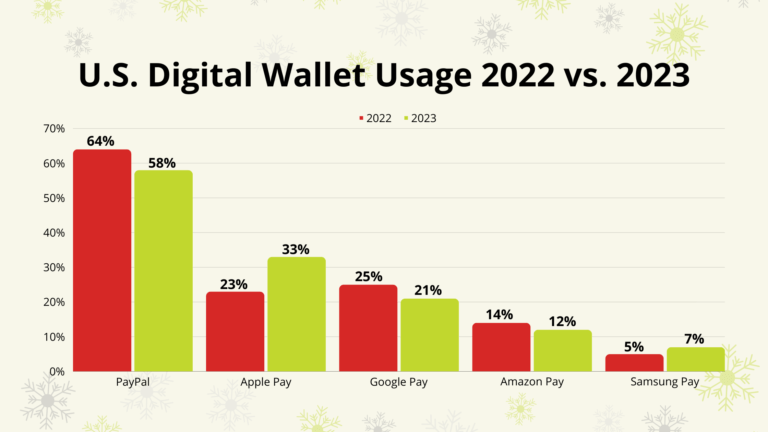

Apple & Samsung Usage Grows

With the rising availability of digital wallet services, 23% of shoppers are confident leaving the house without their physical wallet! This season, PayPal remains the top provider; however, Apple Pay made significant year-over-year gains, with 33% of digital wallet users using this method. PayPal saw a slight decrease in usage compared to 2022, indicating a shift to mobile-driven payments like Samsung and Apple Pay.

What does this mean for banks and credit unions?

As consumers rely heavily on digital wallets, seamless integration with existing credit and debit card products is essential to thrive long-term. Additionally, incentivizing customers to use cards as the primary method on mobile services like Apple and Samsung Pay is vital to gaining digital wallet share and increasing transactions throughout the season.

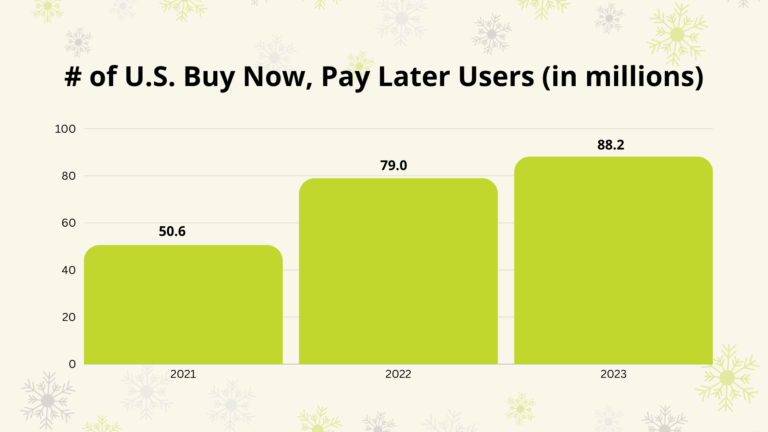

Buy Now, Pay Later Opportunities

As many stretch their budget this season, Buy Now, Pay Later (BNPL) services emerge as a viable option for making holiday purchases, growing to 88.2 million users during the 2023 holiday season. Now available directly at many major retailers, consumers can cover their purchase costs with a short-term payment plan. Purchases are divided into multiple equal payments, with the first due at checkout, and the remaining are billed to a debit, credit card, or bank account. These are commonly run by major fin-tech organizations with interest rates that range from 0-36% APR, depending on the company and retailer. However, some traditional financial institutions have begun to enter the arena of Buy Now Pay Later services. Super-regional Citizens Bank recently rebranded its Citizen Pay BNPL service with the approach of being selective and strategic, tailoring its product to individual mass retailers at a sweet spot of about $500 to $5,000 per loan, going as high as $25,000.

What does this mean for banks and credit unions?

The fading stigma of personal lending creates the opportunity to swoop in by maximizing the convenience and transparency of the Personal Loan process. With the competitive rates and trustworthiness of local FI’s, remaining competitive comes down to staying in from customers throughout the season as they need funds on the fly.

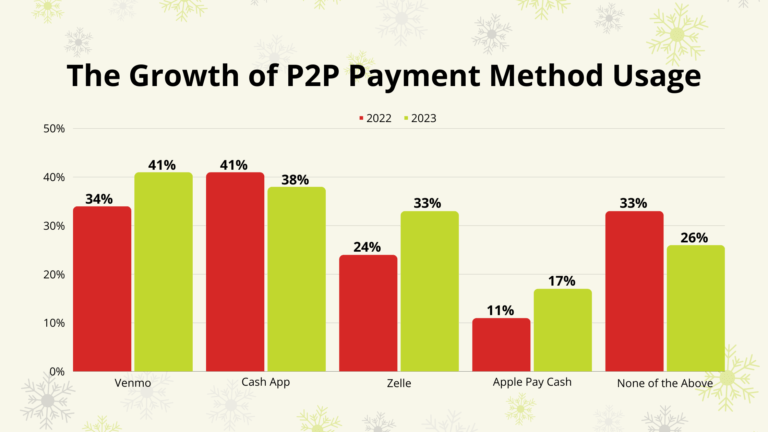

Peer-to-Peer Payments on the Rise

About 74% of consumers have used a Peer to Peer (P2P) app in 2023, a number that’s continued to rise year over year. Whether splitting the cost of a group gift or sending money for a virtual holiday gathering, P2P platforms like Venmo, PayPal, and Cash App offer a convenient and instantaneous way to exchange funds during this busy time of year. While Venmo reigns as the top-used app this year, Zelle® is among the fastest-growing services and is securely integrated into an existing financial institution’s system.

What does this mean for banks and credit unions?

Remaining competitive amongst other banks and credit unions comes down to offering P2P payment services like Zelle®. It’s also important to note that services linked directly with financial institutions are advantageous over fin-tech options like Venmo, which does not offer insurance on funds. Even if you are not offering P2P services yet, being aware of their popularity and providing educational resources around safe usage is essential in protecting customers and members.

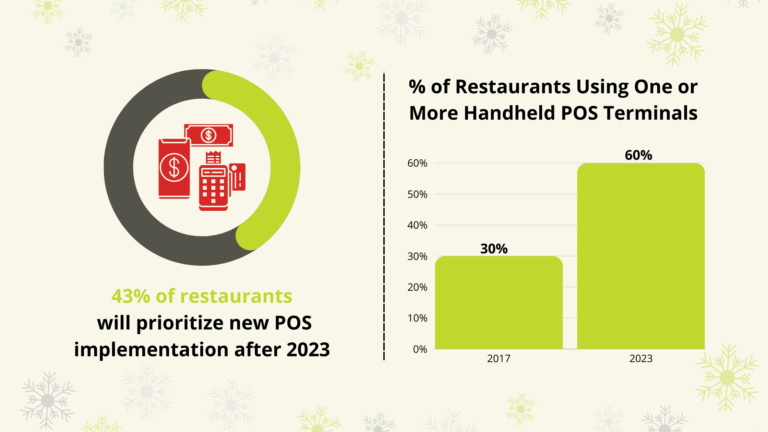

The Restaurant Payment Revolution

With all the chaos this time of year, 60% of holiday revelers plan to dine out during the holiday season. Using the traditional methods of taking orders, generating checks, and processing payments can take up to 30% of a server’s shift; many restaurants are moving into new methods of handling these tasks with handheld POS terminals. These terminals allow servers to collect orders generated into checks that the customer can pay at the table, all using the same device. Adopting this new payment method has allowed many to reduce table turnover time, decrease wait times, and more during this busy time of year.

What does this mean for banks and credit unions?

Since 90% of restaurants are small businesses, banks and credit unions offering business banking services must stay abreast of these changes. Handheld POS terminals have growing demand year over year, and those offering business merchant services should ensure they and their partners are adapting to this new technology. Additionally, providing educational resources for businesses based on secure usage and fraud prevention will only protect the businesses and customers you serve.

Working on your 2024 strategy? Strategis is a full-service marketing agency developing strategies proven to increase (ROI) through a wide range of methods. Book an introduction call or contact us directly!