Embracing the New FedNow Instant Payment System

It’s essential for local financial institutions to stay ahead of the curve and offer innovative services that meet the changing needs of their customers! The FedNow Instant Payment system, introduced by the Federal Reserve, is among the most recent groundbreaking developments in the industry. This system presents an exciting opportunity to revolutionize the way payments are processed and comes with numerous benefits of embracing this new system!

What is the FedNow Instant Payment System?

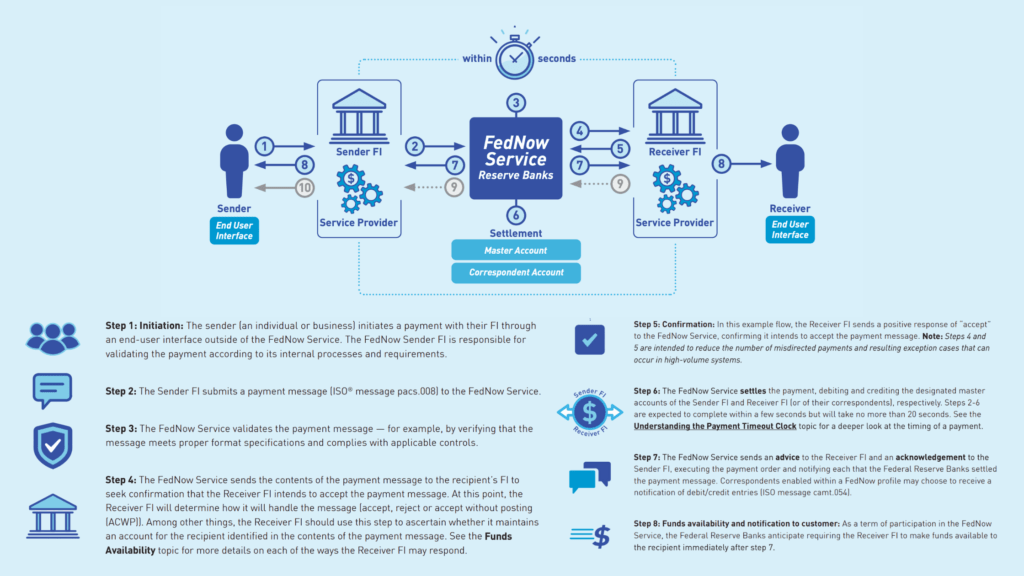

The FedNow Instant Payment system is a real-time payment infrastructure developed by the Federal Reserve. It aims to enable financial institutions to provide their customers with the ability to send and receive instant payments, 24/7, 365 days a year, via an 8-step process that takes seconds. This system will operate alongside existing payment systems, offering a seamless experience for customers and businesses alike.

What does this mean for existing payment systems?

The Fed does not intend to kill or replace other money transfer options like Zelle, Venmo, or PayPal. Instead, the FedNow system is meant to work alongside these systems that have arisen in the private sector. However, the FedNow is a game changer for the thousands of financial institutions that use the Fed’s slower payment system. There is also the Real-Time Payments (RTP) network, a private service used by more than 100 financial institutions for instant fund transfers. Zelle is the only app-based payment system in this network, which is why it can be offered directly in mobile banking apps. It’s essential also to note that any bank or credit union currently using the (RTP) network can also use the FedNow system.

The Benefits of the FedNow System for Banks & Credit Unions

Enhanced Customer Experience

The FedNow system allows for real-time payment capabilities, eliminating the need for customers to wait for funds to settle. This instant transfer of funds will transform the customer experience, providing greater convenience, speed, and flexibility. Customers can make time-sensitive payments, pay bills immediately, and respond swiftly to financial emergencies.

Competitive Edge

By embracing the FedNow Instant Payment system, local financial institutions can gain a significant competitive advantage. Offering real-time payments positions them as an innovator who is responsive to customers’ changing needs. This can help attract new customers, retain existing ones, and build a strong reputation within the community.

Increased Efficiency

With the FedNow system, your institution can streamline its payment processes. The traditional delays associated with processing payments will be significantly reduced, eliminating the need for overnight batch processing. This efficiency can lower operational costs, enhance cash flow management, and improve financial performance.

Boosted Small Business Support

Local businesses are the backbone of our economy, and the FedNow Instant Payment system offers entrepreneurs and small business owners a lifeline. Instant payments can provide critical cash flow management, better inventory management, and greater financial stability for these businesses. Banks and credit unions offering this service are positioned to be trusted partners in their growth and success.

Implementing the FedNow System

1. Prepare for Integration

Evaluate your existing payment infrastructure and determine the necessary steps for integration with the FedNow system. This may involve upgrading your systems, partnering with third-party providers, or consulting with experts in financial technology.

2. Educate Staff & Customers

Ensure your employees are well-informed about the benefits of the FedNow system. Provide training to your staff so they can effectively communicate these advantages to your customers. Educate your customers about the new instant payment capabilities and highlight the value it brings to their financial lives.

3. Emphasize Security

Address any concerns customers may have about the security of instant payments. Implement robust security measures and educate your customers about the safeguards in place to protect their transactions and personal information.

4. Market Your Institution’s Advantage

Promote the FedNow Instant Payment system launch as a significant milestone for your institution. Highlight the benefits to your customers and showcase your commitment to providing cutting-edge financial services. To create awareness and excitement, utilize marketing channels, such as social media, newsletters, and website banners.

Looking to increase engagement with your community through influencer marketing? Strategis is a full-service agency developing strategies for community banks and credit unions proven to increase the (ROI) through various methods. Book a 30-minute introduction call with us, or contact us directly!