The Future of Personalized Banking: Data-driven Marketing Strategies for Banks and Credit Unions

In today’s dynamic banking landscape, personalized banking has emerged as a cornerstone of customer-centricity. As banks and credit unions strive to meet the evolving needs and preferences of their customers, data-driven marketing strategies have become instrumental in delivering tailored experiences. With a data-driven strategy, retailers and brands can steer consumers in the right direction. Data should be the foundation underpinning three core pillars: optimized marketing, end-to-end visibility, and hyper-personalization.

Personalized banking transcends generic offerings by leveraging insights gleaned from customer data. This approach enables institutions to anticipate individual needs and preferences, fostering deeper customer engagement and loyalty. At the core of personalized banking are data-driven marketing strategies that enable institutions to harness the power of customer data. By segmenting customers based on various criteria and employing predictive analytics, banks can deliver hyper-targeted marketing campaigns. These campaigns are designed to resonate with customers on a personal level, offering relevant products and services at the right time and through the right channels.

By integrating data across multiple touchpoints and leveraging machine learning algorithms, banks can deliver personalized recommendations in real-time. This ensures that customers receive tailored solutions, whether it’s a mortgage refinancing option or a retirement savings plan. Despite the immense potential of data-driven marketing, institutions must navigate challenges related to data privacy and security. Maintaining robust data governance frameworks and complying with regulatory standards are crucial to safeguarding customer information. Transparency and consent are equally important when it comes to collecting and utilizing customer data for marketing purposes. Institutions must communicate their data practices clearly and provide customers with opt-in mechanisms for data sharing.

By prioritizing trust and integrity, banks can build long-term relationships with their customers trust and loyalty. As the banking industry continues to evolve, personalized experiences will remain key to staying ahead in a competitive market.

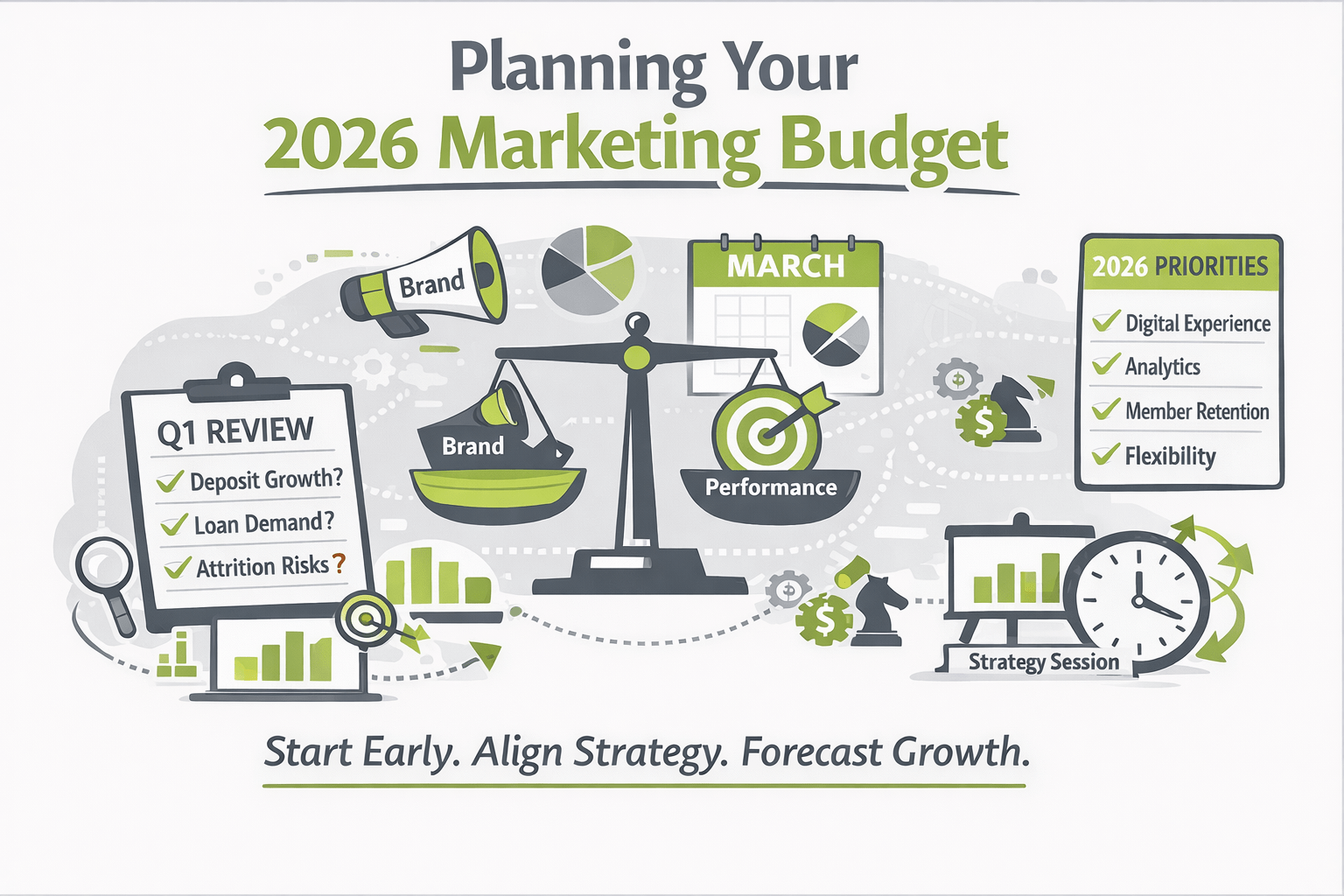

The journey towards becoming an experienced data-driven marketing organization is progressive. It requires investment across three categories of capabilities: people & process, technology & tooling, and data & analytics. In addition, data-driven marketing makes it possible to measure performance more accurately. This creates a basis for continuous improvement – for example, by optimizing target groups or tailoring measures to the customer in a more targeted manner. The goal is to increase customer focus and creativity.

The future of personalized banking hinges on embracing data-driven marketing strategies. By leveraging customer data responsibly and ethically, banks and credit unions can deliver unparalleled value to their customers while fostering trust and loyalty. As the banking industry continues to evolve, personalized experiences will remain key to staying ahead in a competitive market.

Ready to elevate your banking experience with personalized strategies? Let Strategis lead the way in maximizing your ROI through innovative data-driven marketing techniques. Book an introduction call or contact us directly!