Utilizing Data-Driven Decision-Making in Marketing

In these uncertain times, making decisions regarding your financial institution’s marketing strategy based on intuition is unsustainable. Instead, data-driven decision making is the best way to stay competitive in the market and achieve your marketing objectives with successful campaigns that produce a positive return on investment (ROI). By leveraging data and analytics with these steps, you can make informed and strategic marketing decisions that improve customer experiences, increase operational efficiency, create better bottom-line results, and more.

The Process

1- Start with a Goal

The first step towards making data-driven decisions is to set a primary marketing campaign goal or focus. This could be anything from increasing website traffic to generating more low-cost deposits. It’s essential to choose a campaign goal that can be easily tracked so that you can make the most accurate decisions. Additionally, it should align with the organization’s big-picture goals to create the most long-term value.

2- Devise a Strategy

2- Devise a Strategy

Partner with a subject matter expert to determine the best path to achieving your goal. Whether advertising a campaign on specific platforms to reach your target audience or adding new features to the website that make your customer journey smoother. You’ll also need to identify relevant metrics to track progress and success.

3-Collect & Analyze Data

3-Collect & Analyze Data

Collect and analyze your data with experts to identify the actual results. As the campaign runs, collecting data regularly will help determine whether it meets its goals and where improvements can be made. Collecting data consistently and accurately is crucial to ensure that the insights gained from the data are reliable. Regularly improving campaigns will run more efficiently and improve operational efficiency in the long term.

4-Make Decisions

4-Make Decisions

The final step is to use the data to guide your decisions for future campaigns. This involves presenting the results in a digestible format for all stakeholders. The data can be delivered through reports, dashboards, and presentations and are most effective when put together by experts. This will enable your organization to make informed decisions about your marketing strategy, tweak as needed, and achieve better bottom-line results with each new campaign.

The Benefits

Accurate Targeting

By closely examining the data collected during campaigns, marketers can gain insights into the preferences and behaviors of their target audience. Using this data, they can create targeted marketing campaigns more likely to resonate with the intended audience.

Risk Management

Marketers can minimize the risk of loss when comparing external market trends against campaign results. Identifying potential risks and making informed decisions about portfolio management strategies can help mitigate potential losses and optimize marketing investments.

Personalization

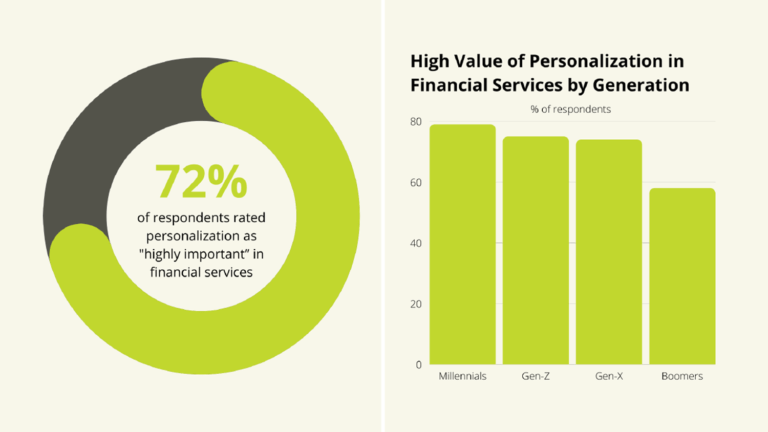

Using data, marketers can create personalized offers and messaging that align with individual customers’ specific needs and interests. This can help improve customer loyalty and retention, as 72% of customers rate personalization as “highly important” in financial services.

Need help making data-driven decisions? Strategis is a full-service agency developing strategies for community banks and credit unions proven to increase the (ROI) through various methods. Contact us today!