5 Reasons to Consider a Different Kind of “Mobile Banking”

It’s time to think “outside the branch”! While digital banking services remain on the rise, bank branches are not entirely obsolete. We recently reported that 82% of customers believe having a nearby branch is extremely or very important, but it’s no secret how expensive they can be to open and operate.

In recent years banks and credit unions in the U.S. have begun adding mobile branches to reach customers via trucks, vans, towable trailers, or RV-type vehicles outfitted with ATMs, teller windows, and in some cases, private loan offices. These units come packed with advanced security cameras and other measures to protect team members, the vehicle, and anything in them, with local police, notified where they are parked. Some even operate as “cashless” branches where tellers do not handle cash but still include other services such as issuing debit cards and storing cash safely in ATMs. In these uncertain times, those looking to expand their operation, downsize without disrupting their services, or further serve existing customers should consider the benefits of operating a mobile branch.

#1- Face-to-Face Marketing Opportunities

With in-person interactions and events coming back to life in recent years, taking your marketing on the go is essential! Face-to-face marketing with your mobile branch at sporting events, concerts, and other community events provides convenient access for existing customers and the opportunity to attract new ones. For example, outfitting your branch vehicle with an ATM at the county fair saves customers the headache of running out of cash and establishes dependability in the community. Additionally, there are opportunities for reaching niche audiences, whether it be visiting students at a nearby college or the office of an (SEG) Select Employer Group. Targeting students at a nearby college could be as easy as parking for the first week of the semester, encouraging (or incentivizing) students to open accounts, and providing educational resources to help them along a financially healthy semester.

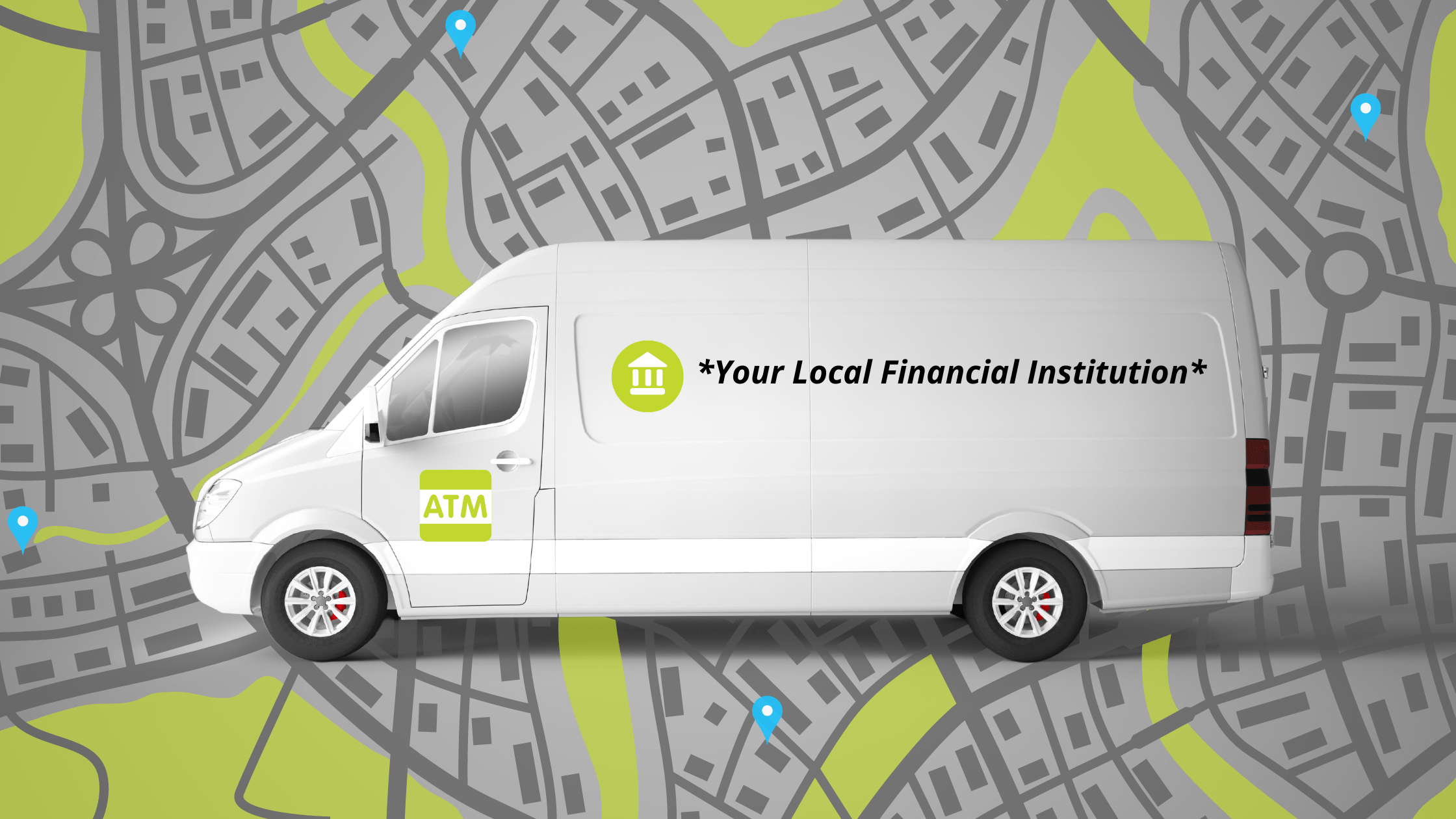

#2 – Enhanced (OOH) Out-of-Home Advertising

(OOH) Out-of-Home Advertising is a timeless way to market for your financial institution, but it can be costly. Mobile branches are a great way to cut down this budget and take control of advertisement locations with a thought-out strategy to reach new and existing customers. We recommend making the most of the canvas a branch vehicle provides by adding a standout exterior and interior design complete with branding and digital screens for cross-selling.

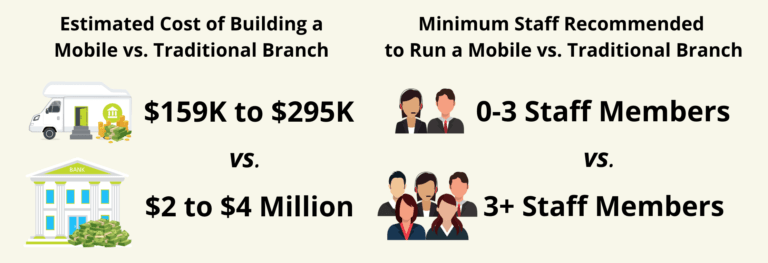

#3 – Cost-Effective Branch Alternative

Cutting costs seems to be on everyone’s to-do list these days. In light of this, we are happy to share that the cost of setting up a mobile branch was most recently estimated at $159,000 to $295,000, whereas the cost of creating a new traditional brick-and-mortar branch averages $2 to 4 million. Staffing costs are also much lower, holding a single loan officer or teller, with others not requiring any staff as they solely hold an ATM. This cost-friendly alternative opens the door to reaching multiple portions of the community needing a branch at a fraction of the price. The president of a company specialized in building mobile branches states of their customer’s motives, “There’s a lot of branches closing everywhere, so they’re looking for other ways to reach out to these smaller communities where it just doesn’t make sense to have a brick-and-mortar branch.”

#4 – Reach “Underbanked” Households

Communities provide a foundation for a local financial institution’s success. Providing them with the support they need is key to solidifying this foundation. Mobile bank branches allow for flexibility in several geographic areas, whether reaching those “underbanked” in the community or providing aid in natural disasters. According to the FDIC, 18.7 million U.S. households were labeled as “underbanked” in 2021, meaning they used other credit products or services to fulfill non-bank transactions. Identifying areas of the community where these households reside and periodically increasing the presence of your mobile bank branch there may provide the slow introduction to banking, they need.

#5 – Provide Disaster Recovery

When natural disaster strikes, a mobile bank branch opens the door for providing services, even when traditional branches become non-operational. This benefits both customers who may need emergency financial assistance due to lost property, etc., and employees who would be able to avoid gaps in income. Not only will this keep things up and running, but it’s also an excellent opportunity to provide other assistance or resources to those affected and strengthen relationships in the community.

Looking to make a new impact with a mobile branch? Strategis is a full-service marketing agency developing strategies proven to increase the (ROI) through a wide range of methods for localized financial institutions. Contact us today!