Holiday Shopping Season 2021: Trend Update

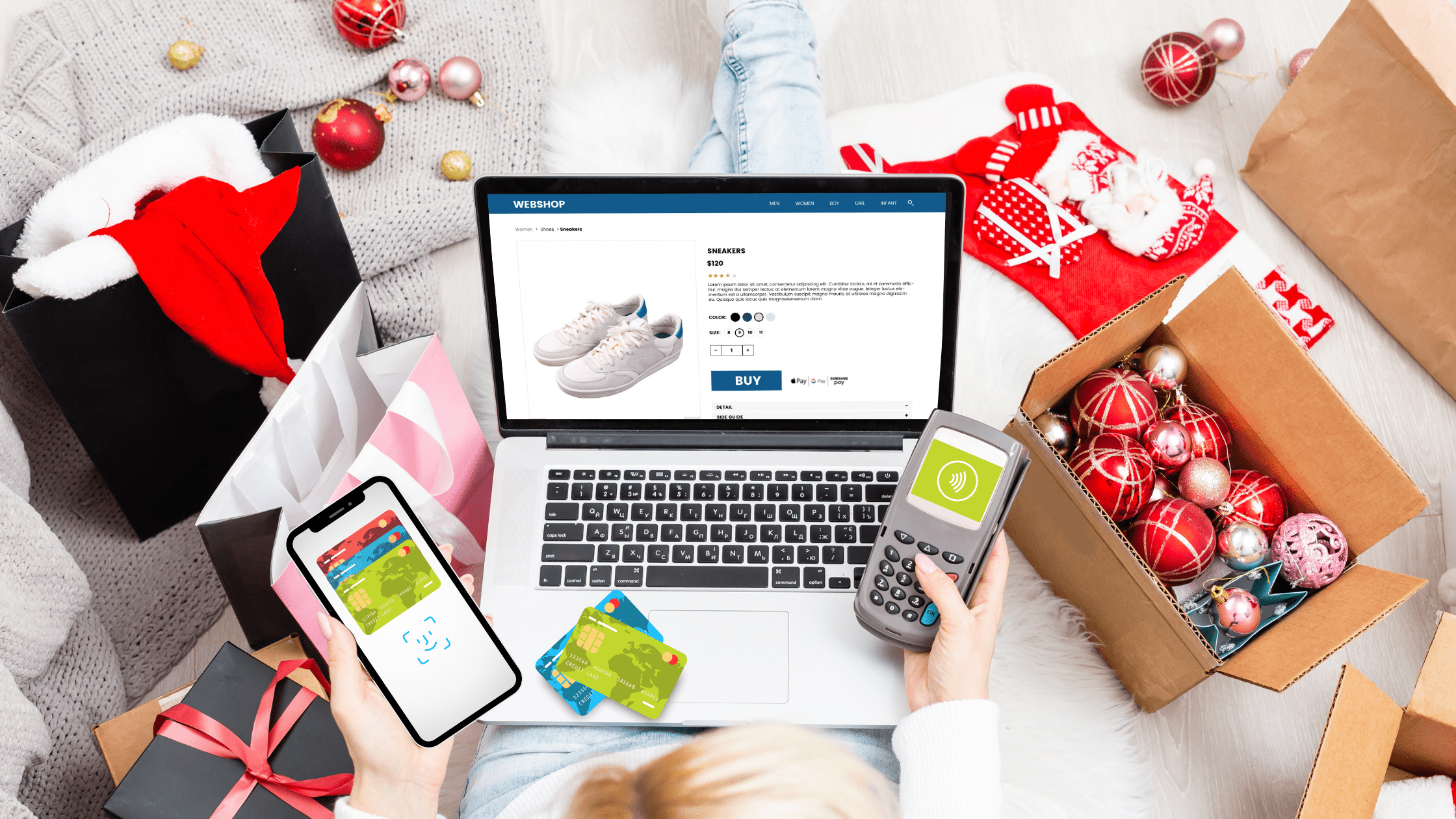

Over the past two years, the holiday shopping season has evolved from endless shopping trips at the mall to crossing your fingers that your online orders will be delivered in time. In the aftermath of COVID-19, the ways of holiday shopping have shifted exponentially, as the growing majority do their shopping online, leaving behind an industry that must strive for evolution. This leaves many consumers and businesses wondering what the current state of holiday shopping is and why their packages are not arriving on time.

Our banks and credit unions lie at the foundation of the holiday shopping season. Therefore, it’s essential to stay vigilant to these ongoing changes in the market. To get a better sense of where holiday shopping is headed, check out these current trends of the 2021 holiday season and what it all means for the future of financial institutions during this time of year.

Early-Bird Shopping Booms

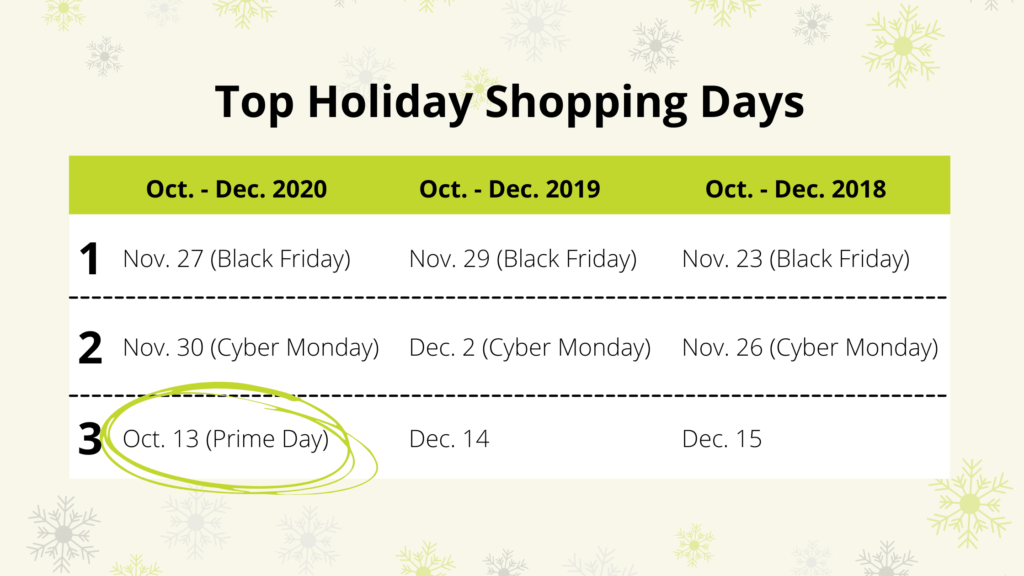

The looming threat of shipping delays and stocking issues experienced last year caused many holiday shoppers to start earlier than expected. As of November 1st, an Oracle survey reported that 52% of consumers had already begun holiday shopping or had plans to start earlier than usual. This trend is continued from last year’s holiday shopping season, where the most significant day for holiday shopping was October 13th, 2020 (Prime Day) behind Black Friday and Cyber Monday as opposed to 2019 and 2018’s third-biggest shopping days being December 14th and December 15th respectively. The numbers for the current shopping season (Q4) ending in December are expected to be in line with this current trend due to the steady growth in the number of shoppers who started shopping before Thanksgiving.

What does this mean for financial institutions?

What does this mean for financial institutions?

With shoppers and retailers starting early, instead of starting holiday loans and credit card campaigns in November/December, be prepared to start them in September/October next year. This will ensure that the growing number of early-bird shoppers can acquire the financing they need to get their shopping done early.

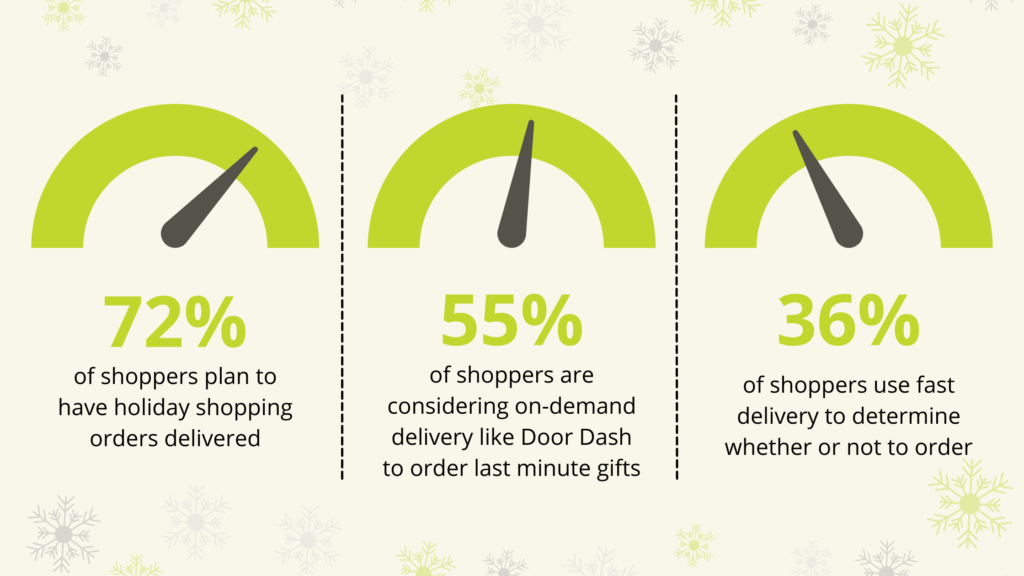

The Birth of Cyber Month

With the average customer starting their shopping early this season, businesses are getting a head start on their holiday sales. This mindset has caused the birth of Cyber Month, during November where top retailers kick off their season-long sales to attract these early-bird shoppers. According to oracle.com, 72% of shoppers had plans to have their orders delivered going into this season. Still, only 36% factored fast delivery into their purchasing decision, their solution being to start shopping early. For those looking for last-minute gifts, 55% of people plan to turn to on-demand delivery options such as Door Dash or stores offering a same-day drop-off option.

Many businesses and customers question what Cyber Month means for traditional shopping events like Black Friday and Cyber Monday. While sales continued to be available all month, these events are far from gone and serve as the peak of Cyber Month. However, they are beginning to evolve online, with many sales being available online both of these days and more people than ever holding out for Cyber Monday, which surpassed Black Friday sales in 2021 by $1.8 billion. The ongoing supply chain issues will continue to pressure these events in the coming years, but many businesses will seek ways to improve and salvage their most important shopping days of the year.

What does this mean for financial institutions?

What does this mean for financial institutions?

Cyber Month drives increasing traffic online from shoppers taking advantage of the new season-long sales. To gain shoppers’ attention during this time, it is essential to have an effective online presence through digital banking services promoted through social media and search engine advertising.

Omni-channel Shopping

Technology is everything nowadays and to get the most out of the holiday shopping season, having the right functional technologies and digital presence in place is essential to keeping up with the competition. Blending this with offline touchpoints in the store is vital in creating the hybrid shopping experience many shoppers are beginning to expect. This expectation is due to having seen the online capabilities of many businesses at the peak of COVID-19 and having an expectation for the pre-COVID in-store experiences that many have missed.

One of the easiest ways to adapt to this new environment would be having the option to come into the store for pre-ordered pick-up, reaching the customer online, convincing them to bypass slow shipping times. This also creates the opportunity to sell additional items when they arrive for pick-up. The most successful version of this has an item advertised heavily online, available to purchase in the store. Nowadays, it’s not just the sales that get shoppers in the door from reaching them with online ads to getting them in the door with in-store pick-up options; these are the real heroes of the 2021 holiday season.

What does this mean for financial institutions?

What does this mean for financial institutions?

Take notes from your favorite retailers’ new omnichannel shopping experiences and add digital and offline touchpoints to your holiday events. From fundraisers to fun holiday parties for your customers, offering experiences that allow for in-person and online engagement will ensure that no holiday shopper is left out.

Supply Chain Growing Pains

Online holiday shopping grew exponentially in the wake of COVID-19, forcing the manufacturing and shipping industries to grow at a nearly impossible rate. Businesses and consumers can feel the pain as it was reported that there were over 2 billion out-of-stock messages online in October 2021, before the bulk of the holiday sales even began. Therefore, this global supply chain crisis has affected holiday shoppers’ shipping times and general needs year over year.

More retailers than ever before have taken more control over their supply chain to rise above this crisis. Large retailers like Target, Walmart, and Costco have chartered their own shipping container ships to control their shipping process and avoid delays caused by congested ports and unnecessary stops. This is the first of many steps for retailers and online sellers to adapt to these growing pains in the global supply chain.

What does this mean for financial institutions?

What does this mean for financial institutions?

Re-analyze your customer experience and create one of increased patience and understanding. The holidays have always been a busy and stressful time of year for many, and now there is the added stress of shipping issues and increased out-of-stock signs. If customers know that their financial institution provides support and understanding during this time, their loyalty will only increase.

Are you struggling to keep up with the trends? Strategis is a full-service marketing agency developing strategies proven to increase the (ROI) through a wide range of methods that will help you keep up during every season. Contact us today!