Reaching & Engaging the Next Generation of Financial Institution Customers

Who is This Audience?

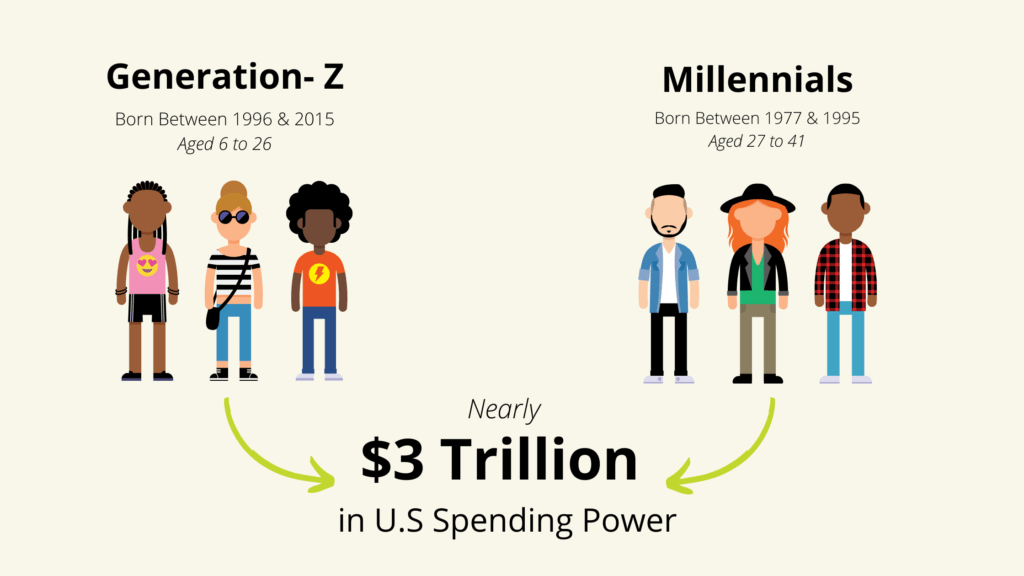

The next generation of financial institution customers will be Gen-Z born between 1996 and 2015 aged 6 to 26 years old and millennials born between 1977 and 1995 aged between 27 to 41 years old. Millennials are approaching their prime spending years as they are the largest generation in the workforce and the fastest-growing generation of customers in the marketplace. With their rapid growth, millennials have established themselves as having the most significant customer lifetime value compared to the other active generations in the market. Right behind them is Gen-Z, making waves in the market in any possible way a generation can, with many entering the workforce and making significant decisions regarding their incoming education and housing costs.

Why is This Audience Important?

Both Gen-Z and millennials are well-versed in technology and have a combined spending power of nearly $3 trillion in the United States. These generations can provide financial security for the institution’s future and push further technological development with their willingness to adopt new technologies. While beneficial, reaching and engaging younger generations for many financial institutions is a significant pain point with the average credit union member aged 47 and the average direct bank customer aged 53. However, accessing this spending power can be achievable with the proper methods for attracting, retaining, & nurturing this audience.

Where Can This Audience Be Reached?

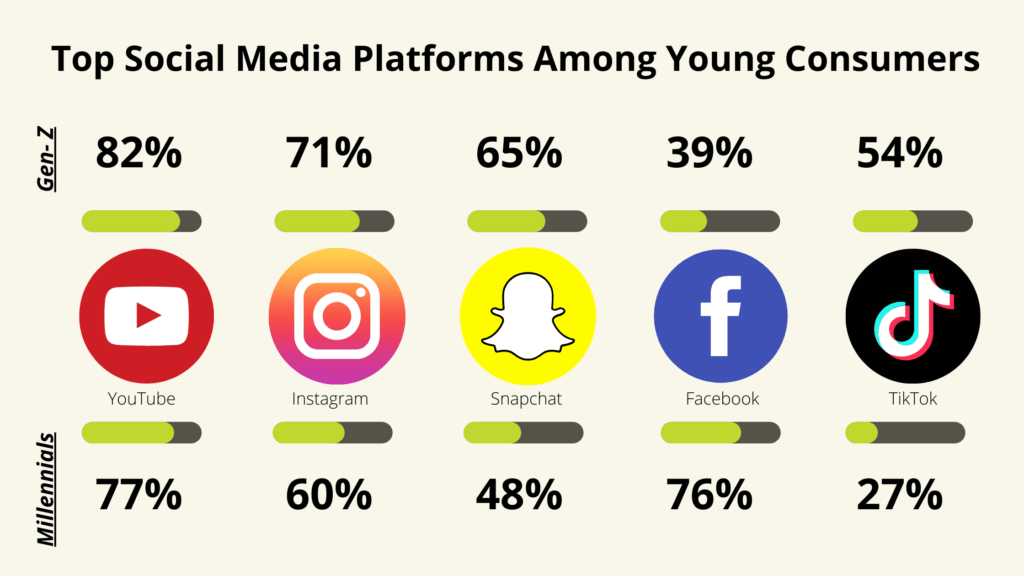

Social media and video advertising are essential methods of reaching younger generations, as proven through their daily smartphone usage. For example, 69% of Gen-Z streams video, and 71% use social media daily. For millennials, this is similar as 77% use social media and 57% watch videos daily.

The most popular social media platforms among younger generations are YouTube, Instagram, and Snapchat. In addition, most millennials can be reached on Facebook, whereas TikTok continues to grow exponentially, earning an audience consisting of both generations. Organizations should regularly publish paid and organic content to fully utilize these platforms to establish the institution as a reputable source and attract increased user engagement.

Video advertising through social media and popular streaming or OTT Media services such as Netflix, Hulu, or HBO Max is a great way to reach this audience. Both millennials and Gen-Z claim that streaming TV and movies is also their top weekly activity, with 92% of Gen-Z claiming to watch content through a streaming service weekly and 89% of millennials doing the same. This consistent access to these platforms will only increase during the winter months and holiday season as more time is spent indoors with friends and family

What Engages this Audience?

Accessibility is essential to engaging with and meeting the needs of younger generations, as they are always on the go, constantly interacting with technology, and seeking the easiest ways to learn new things.

Being part of a nationwide ATM network provides these customers access to their money without fees anytime, anywhere. These networks can vary in size, giving access to upwards of 60,000 surcharge-free ATMs nationwide.

Another central point of engagement is offering the latest digital services such as online banking, mobile banking, bill pay, card controls, and more so they can handle their finances anywhere, anytime. In addition, P2P payment services such as Zelle® and Popmoney® allow for secure and fast sending of payments to friends and family and are perfect for nights out or splitting expenses with roommates.

Lastly, these generations are at the pinnacle of making major financial decisions regarding housing, education, and setting up long-term retirement plans. Therefore, providing educational materials such as webinars, blogs, and financial calculators in these areas will help them reach their financial goals and create customer loyalty that will span their lifetime financial journey.

Ready to reach and engage the next generation of customers? Strategis is a full-service marketing agency developing strategies proven to increase the (ROI) through a wide range of methods. Contact us today!